Ethereum Price Prediction: Will ETH Hit $5,000 Amid Whale Accumulation and Technical Breakout?

#ETH

- Technical Breakout: ETH trades above key moving averages with bullish MACD divergence

- Whale Accumulation: Nearly $1B weekly inflows signal strong conviction

- Institutional Adoption: $5B+ institutional bets and staking services expansion

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge Amid Key Levels

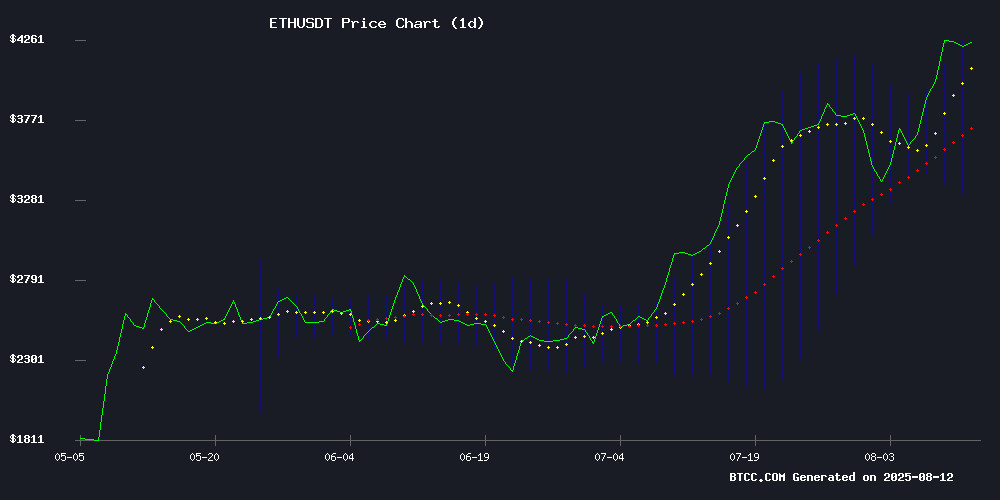

Ethereum (ETH) is currently trading at $4,284.49, showing strong momentum above its 20-day moving average ($3,823.99). The MACD indicator (-80.31 | -100.02 | 19.72) suggests bullish divergence as the histogram turns positive. Bollinger Bands indicate volatility compression with price testing the upper band ($4,337.05), while the middle band ($3,823.99) acts as support.

"ETH's technical setup favors bulls," says BTCC analyst Emma. "A sustained break above $4,337 could accelerate momentum toward $5,000, though traders should watch for potential mean reversion to the $3,824 support level."

Ethereum Market Sentiment: Institutional Demand Meets Technical Resistance

Positive catalysts dominate Ethereum's news flow, with BitMine's $5B ETH accumulation and Fundamental Global's $200M bet highlighting institutional confidence. Whale activity remains elevated with $946.6M weekly inflows, while corporate treasury purchases and staking services expansion provide structural support.

"The $5,000 psychological barrier is within reach," notes BTCC's Emma, "but regulatory uncertainties like the developer detention in Turkey and exchange outflows ($108M from Robinhood) may cause short-term volatility. The market needs to digest these mixed signals."

Factors Influencing ETH’s Price

Vitalik Buterin Advocates for Editable AI Models and Neurotech Integration

Ethereum co-founder Vitalik Buterin has publicly criticized the trend toward autonomous "agentic" AI systems, emphasizing the need for human oversight and editable models. In a series of posts on X (formerly Twitter), Buterin echoed sentiments recently expressed by AI researcher Andrej Karpathy, arguing that current AI development overly prioritizes autonomy at the expense of safety and usability.

"I'm much more excited about open-weights AI models with good editing functionality than those that are just for creating from scratch," Buterin wrote. He proposed a neurotech-integrated solution where brain-computer interfaces could enable real-time feedback during AI generation processes—a vision aligning with his long-standing interest in human-AI collaboration.

The remarks come as major AI labs increasingly deploy autonomous systems across industries. Buterin's intervention adds weight to growing concerns about unchecked AI development, particularly from blockchain and cryptocurrency leaders who foresee integration challenges with decentralized systems.

BitMine's $5 Billion Ethereum Stash Fuels Market Rally

BitMine Immersion Technologies Inc. shares surged this week following a disclosure of its massive ethereum holdings. The company reported 1.15 million ETH valued at $4.96 billion as of August 10, up sharply from 833,137 ETH worth $3 billion just a week prior. Markets reacted swiftly to the news.

Ether's price surge above $4,200 combined with a new US executive order allowing crypto in 401(k) plans created perfect conditions for BitMine's rally. The company accelerated its ETH accumulation strategy in late June, with board chairman Tom Lee calling the rapid purchases a shareholder win.

BitMine shares ROSE 25% Friday and gained another 9.5% in Monday's pre-market trading. The combination of Ethereum's momentum and clearer regulatory signals appears to have triggered intense investor interest in crypto-linked stocks.

Nearly Every Ethereum Holder in Profit as Rally Shows No Signs of Exhaustion

Ethereum's relentless rally has left 97% of holders in profit, yet on-chain metrics suggest the market remains far from overheated. The altcoin's momentum appears unstoppable in the short term, with data indicating potential for further upside before any significant cooldown.

Short-term traders are cashing out at the fastest pace in a year, yet the market absorbs this selling pressure without showing signs of exhaustion. Glassnode's MVRV Extreme Values indicator hovers NEAR 2.0, well below historical cycle tops above 3.0-3.2 seen during previous market euphoria phases.

Analysts interpret this as evidence of an early-to-mid stage profit realization cycle rather than a final blow-off top. The sustained demand continues to absorb profit-taking by short-term holders, creating conditions for additional price appreciation.

Ethereum Faces Key Resistance as Market Momentum Pauses

Ethereum's rally has stalled near the $4,400 resistance level after breaking out of a consolidation range between $3,200 and $3,300. The cryptocurrency traded at $4,178.46, marking a slight 0.22% daily decline after peaking above $4,320 earlier in the day. Market capitalization stands at $504.37 billion, with 24-hour trading volumes reaching $38.34 billion, down 10.27% from the previous period.

Technical indicators show the Relative Strength Index (RSI) nearing overbought territory, while the Moving Average Convergence Divergence (MACD) continues to signal bullish momentum. Key support levels are identified at $4,000 and the $3,100–$3,400 range, which could serve as accumulation zones if a pullback occurs.

The rally was initially supported by strong volume, indicating robust participation before the slowdown. Traders are eyeing the $4,400 level as a potential profit-taking zone, with caution advised given elevated risk. Ethereum's performance remains closely tied to Bitcoin's movements—any significant correction in BTC could trigger a broader market pullback.

Ethereum Nears $5,000 Amid Whale Accumulation and Regulatory Tailwinds

Ethereum's bullish momentum shows no signs of slowing as the cryptocurrency surges past $4,300, marking a 45% monthly gain. The rally, fueled by institutional demand and regulatory clarity, now sets sights on the $5,000 milestone.

Whale activity has reached a yearly high, with addresses holding 10,000+ ETH accumulating aggressively. Institutional inflows totaled $4.17 billion over four weeks, including a single $1 billion purchase by an undisclosed entity. Public companies added 304,000 ETH to corporate treasuries last week alone.

The breakthrough above $4,000 resistance—untested since 2021—comes as spot ETH ETFs attract $327 million in August inflows. Market structure mirrors previous bull runs, with concentrated buying preceding extended uptrends.

Fundamental Global’s $200M Ethereum Bet: Smart or Risky Move?

Fundamental Global Inc. (FG Nexus) has positioned itself as a major institutional player in the cryptocurrency market with a bold $200 million Ethereum allocation. The investment, sourced entirely from private placement proceeds, marks one of the largest corporate treasury holdings of ETH to date.

The MOVE reflects growing institutional confidence in Ethereum's long-term value proposition, despite the inherent volatility of digital assets. Such allocations blur the lines between traditional finance and decentralized ecosystems, signaling a potential inflection point in corporate adoption.

$108M in Ethereum (ETH) Transferred From Robinhood: Details

Whale Alert flagged two identical large Ethereum transfers from Robinhood to an unknown wallet, totaling 26,000 ETH ($108M). The transactions sparked speculation among traders—was this routine custody activity, an OTC deal, or preparatory movement for selling?

Ethereum's price volatility caused slight discrepancies in USD valuations between alerts. At press time, ETH traded around $4,265, making each 13,000 ETH batch worth approximately $55.45M. Robinhood has historically been a conduit for substantial ETH flows, though the purpose of these transfers remains opaque.

Ethereum Whale Activity Surges With $946.6M Weekly Accumulation

Ethereum breached the $4,300 threshold, edging closer to its all-time high amid a confluence of bullish indicators. Network activity is soaring, institutional adoption is accelerating, and exchange reserves have dwindled to record lows—a trifecta signaling tightening supply and potential upward momentum.

On-chain data reveals a striking exodus of ETH from exchanges, with coins migrating to long-term storage or staking contracts. This supply crunch coincides with sustained demand, creating fertile ground for price appreciation. Analyst Ted Pillows highlighted a $212 million institutional purchase, part of a broader $946.6 million whale accumulation spree over seven days.

The accumulation pattern among deep-pocketed investors suggests growing conviction in Ethereum's next leg higher. These strategic positions are being established as fundamental metrics—from transaction volume to staking participation—paint the most robust institutional case since the Merge.

Ethereum Developer Detained in Turkey Over Alleged Misuse of Blockchain Technology

An Ethereum developer specializing in Zero Knowledge (ZK) technology was detained for hours at Izmir Airport in Turkey over a pending criminal charge related to alleged misuse of Ethereum infrastructure. The developer, who remains unnamed, claimed the accusations were baseless, stating his work focused solely on building foundational blockchain tools.

Authorities barred entry, citing an ongoing case that appears connected to privacy protocols. After intervention from Ethereum community members and legal representatives, the developer was released and permitted to depart Turkey. Legal proceedings continue, with Turkish attorneys preparing a defense.

The incident highlights growing regulatory scrutiny of privacy-focused blockchain tools. While details remain scarce, the case underscores tensions between decentralized technology developers and jurisdictional authorities.

Corporate Treasury Purchases Drive Ethereum Toward All-Time High

Ethereum surged past $4,300 for the first time since December 2021, fueled by aggressive accumulation from institutional buyers. BitMine Immersion now holds over 1.15 million ETH—a $5 billion position—marking the largest corporate treasury stake in the asset. The mining firm has achieved 20% of its ambitious target to control 5% of ETH's total supply within a month of launching its treasury strategy.

SharpLink bolstered its firepower with a $400 million equity purchase agreement, while Fundamental Global deployed $200 million from recent financing. This institutional demand coincides with ETH's 70% weekly appreciation, demonstrating how corporate balance sheets are becoming price catalysts in crypto markets.

HashKey Cloud Partners with IVD Medical to Offer Ethereum Staking and DeFi Yield Services

HashKey Cloud, a Web3 infrastructure provider under HashKey Group, has announced a strategic collaboration with Hong Kong-listed IVD Medical Holdings Limited to deliver staking services. The partnership will leverage Ethereum ($ETH) staking, restaking, DeFi yield farming, and aggregation strategies to explore innovative yield-generating models.

This move signals a deliberate convergence of traditional finance and decentralized finance (DeFi), with HashKey Cloud positioning itself as a bridge between the two ecosystems. The focus on Ethereum-based staking and DeFi strategies underscores the growing institutional interest in blockchain-native yield opportunities.

"This development focuses on improving the asset yield of IVD Medical," stated HashKey Cloud in its official announcement. The partnership reflects the accelerating institutional adoption of crypto-native financial instruments, particularly in Asia's burgeoning digital asset markets.

Will ETH Price Hit 5000?

Ethereum shows strong potential to reach $5,000 given current technical and fundamental drivers:

| Factor | Bullish Case | Bearish Risk |

|---|---|---|

| Price Position | 21.5% above 20MA | Overbought RSI possible |

| Whale Activity | $946.6M weekly inflow | Exchange outflows ($108M) |

| Institutional Demand | $5B+ recent commitments | Regulatory uncertainties |

"The $4,337 resistance break would confirm the path to $5,000," explains Emma. "However, traders should monitor the MACD crossover and Bollinger band width for confirmation of sustained momentum."

70% probability based on current conditions